Academic Program Spotlight – Stock market and trading behaviour analysis

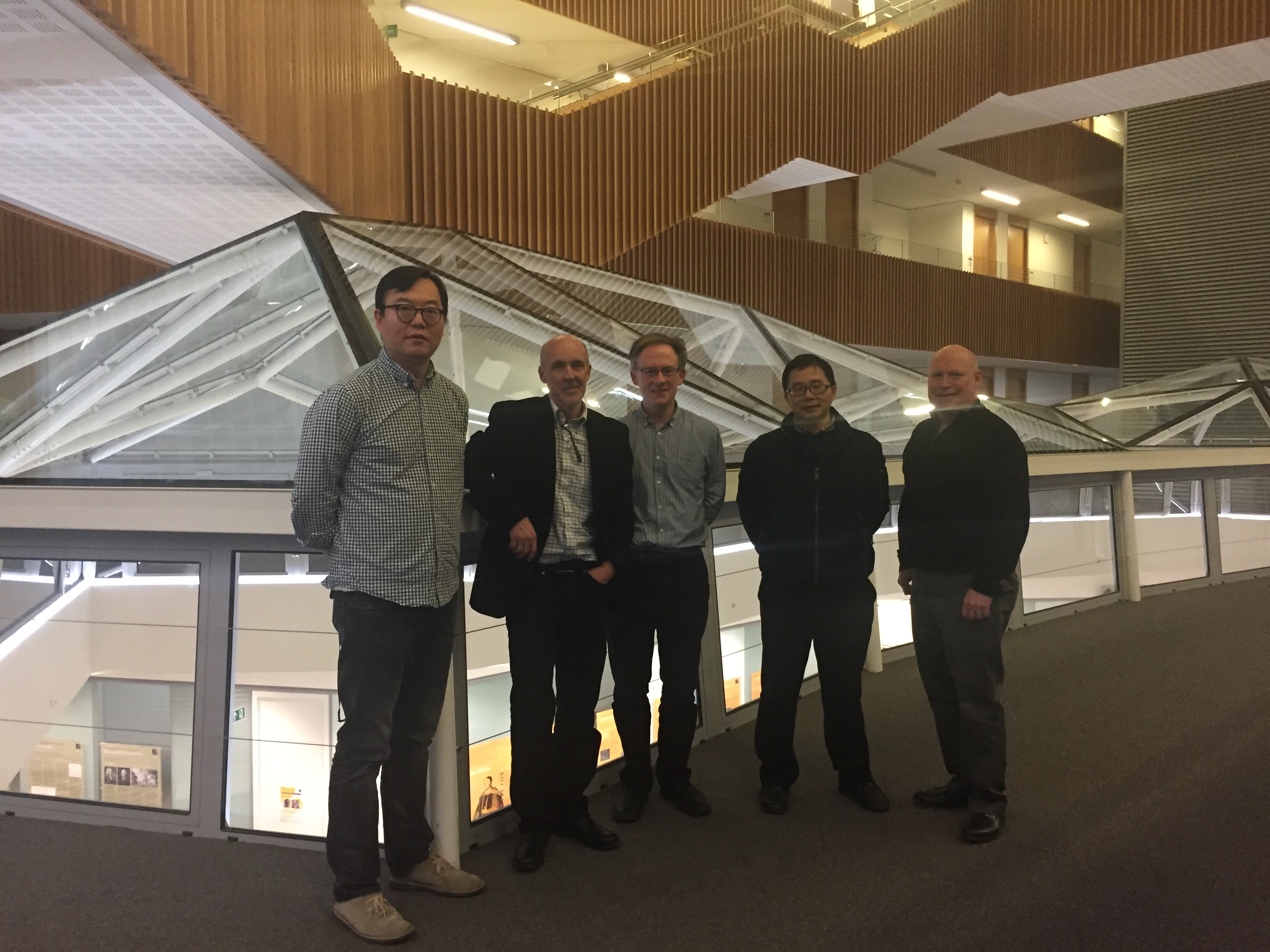

If you haven’t been to the Mathematical Institute at Oxford University, you are missing out on seeing the spectacular sight of their Andrew Wiles Building. Shown below from the inside featuring the iconic ‘Hive’ glass roof used on their stationery and website banner:

From the left, Dr Ning Wang, Dan Camper, Gavin Halliday, Professor Hanqing Jin and Brian Bounds

From the left, Dr Ning Wang, Dan Camper, Gavin Halliday, Professor Hanqing Jin and Brian Bounds

Our collaboration with the Mathematical Institute at the University of Oxford in the UK, supports a research project which focuses on using HPCC Systems to analyse a massive dataset to explore the many possible perspectives of the investor portfolio choice problem.

Markov Portfolio Theory has observed that investors put together a collection of stocks to build optimally diversified portfolios. The diversification is also emphasised in modern portfolio theory in neo-classical finance for rational investors. But despite the fact that such models provide effective normative explanations of how investors should behave, it is unknown whether investors ultimately do behave in this way.

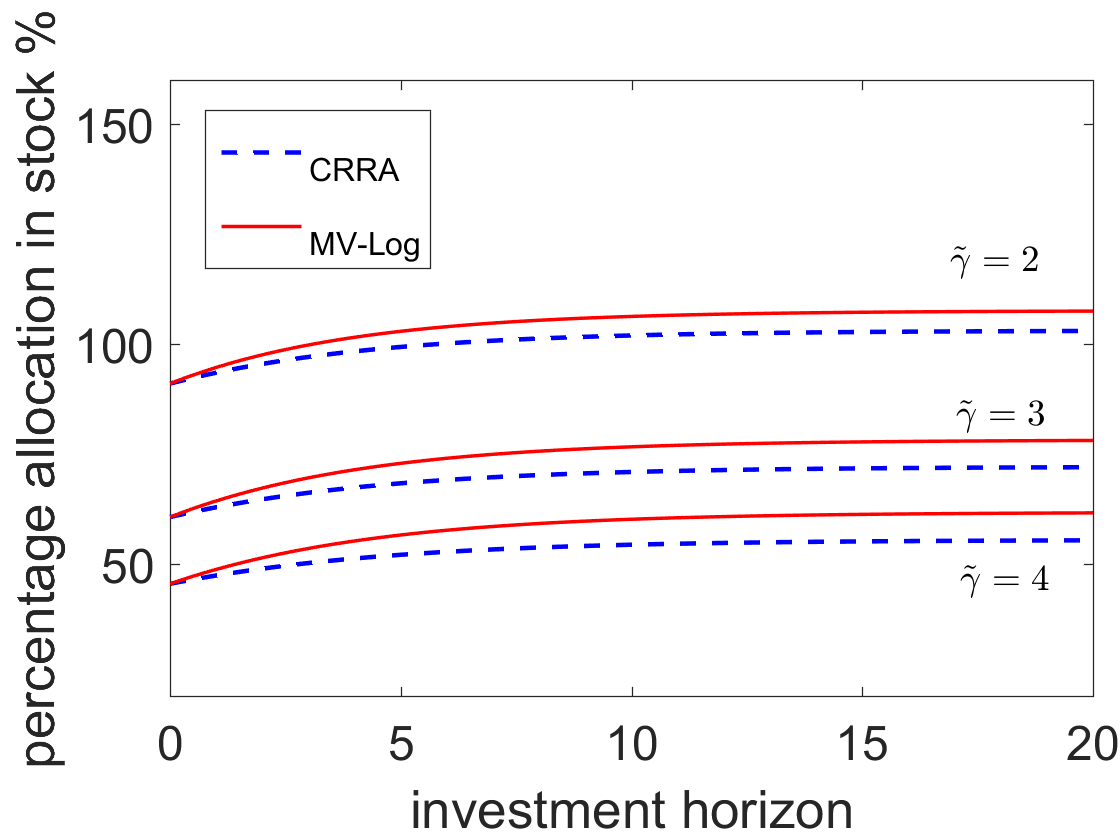

Graph from Professor Hanqing Jin’s recent work on portfolio selection showing the best proportion of investment in stock markets taken from their portfolio selection model.

Graph from Professor Hanqing Jin’s recent work on portfolio selection showing the best proportion of investment in stock markets taken from their portfolio selection model.

Newly released work in behavioral finance illustrates how an investor’s awareness (such as return expectations, risk tolerance, and risk perception) have an impact on actual trading and risk-taking behavior. Even so, it is not clear whether these perceptions adequately explain legitimate trading and risk-taking behaviors. With the challenges from the complicated behaviours, more and more research tends to be data oriented.

By combining massive datasets from trading records and limit order books, this research project seeks to provide clarity about these assumptions, showing how an investor’s perception and behavior impacts their trading decisions.

Once these questions have been answered, the next stage is to quantify investor trading decisions into algorithmic models, which will provide a rational way to formulate the way investors use their knowledge. The challenge here is that this requires high quality investor perceptions and knowledge to develop effective trading algorithms. However there are large amounts of historical datasets and trading records available which can be used to extract the trading knowledge hidden within the data.

Using HPCC Systems, the research team will be able to streamline the process of ingesting, curating, integrating and transforming scholarly data from multiple sources and varying formats, particularly when several of the datasets lack common attributes to support the integration process. Our platform will also help to develop the machine learning models used to analyse and imitate investor behavior. The dataset will originate from many different sources from the financial market and investor behavior. The aim is to combine them into a specific stream which can be used to apply machine learning models.

In 2019, HPCC Systems ran a workshop at the Mathematical Institute to introduce students to our platform and generate interest in the planned PhD research project. The workshop was designed to show students how to get up and running and encourage them to become familiar with how to use our platform to process and analyse large quantities of data. A dataset was found to demonstrate how to use HPCC Systems and machine learning to try to predict the stock market.

Our LexisNexis Risk Solutions colleagues presenting to students: Dan Camper and Lili Xu presenting via live link from the USA

Meet the Oxford University team

Our collaboration involves sponsoring a PhD student to work on this research project for the next three years and we are pleased to be supporting and working with Yuting Fu, who was selected to join to the project towards the end of 2019.

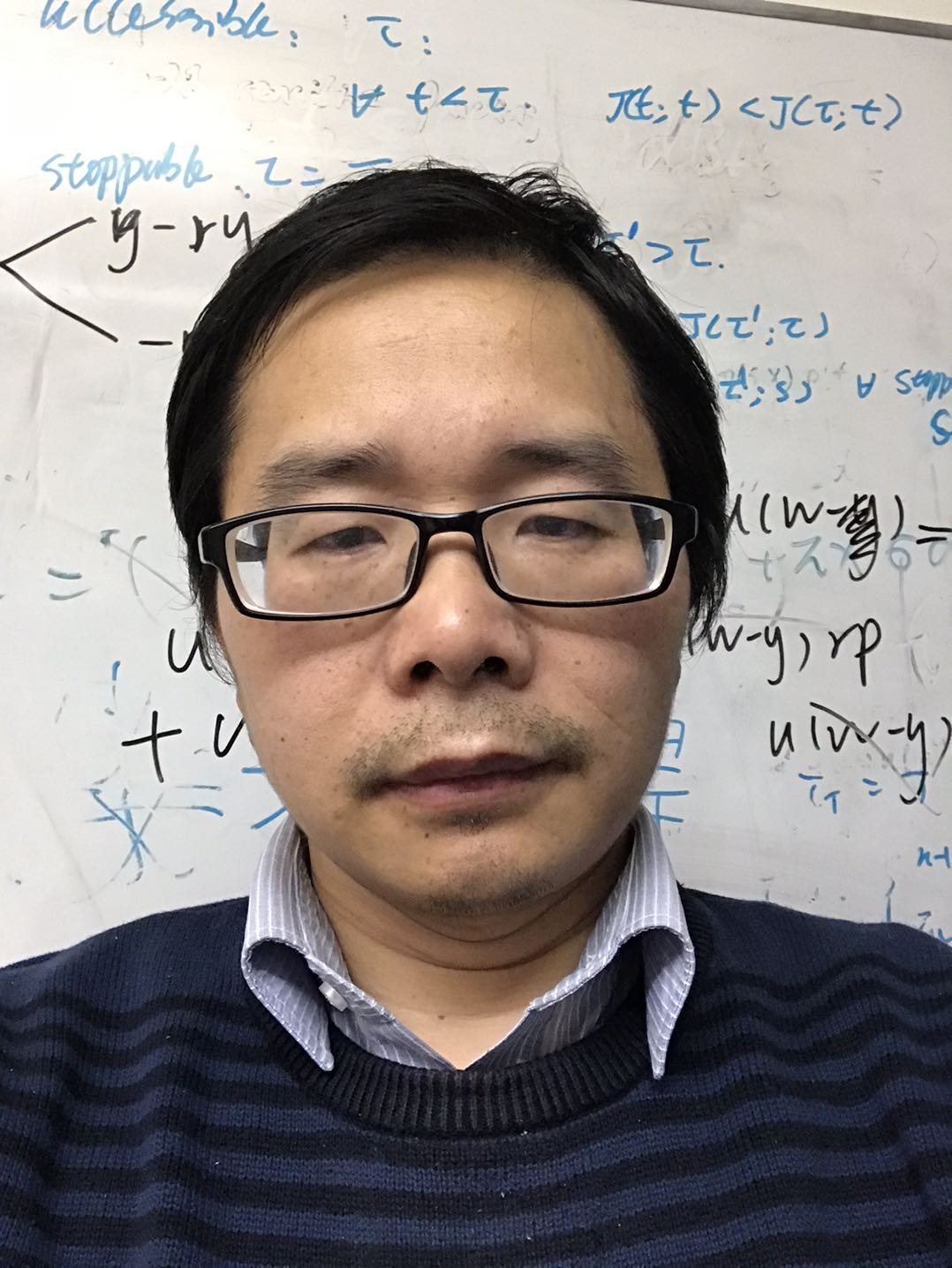

Dr Ning Wang is a Data Scientist and Senior Research Fellow at the Oxford-NIE Financial Big Data Lab. He is also a Research Fellow of St Hugh’s College, University of Oxford and the Oxford Internet Institute. Dr Wang takes a special interest in machine/deep learning in finance, social media and mobile trading platforms, online sentiment analysis and financial markets as well as trading behaviors and performance evaluation.

Professor Hanqing Jin is an Associate Professor at the Mathematical Institute and the Director of Oxford-Nie Financial Big Data Laboratory. His research interest is in mathematical finance, applied stochastic analysis, optimization and financial big data. His work focuses on the study on portfolio selection (by stochastic control and martingale method) and optimal stopping in financial market. Recently he has also worked on behavioral finance, time consistency in portfolio selection models, and robe-advising systems.

Yuting Fu won the first prize of Sichuan Province in the 2014 China National Olympiad in Mathematics. In 2018, she won the 2nd prize of Beijing in the China Undergraduate Mathematical Contest in Modelling. Yuting graduated from Tsinghua University in 2019 with a first class honours Bachelor’s degree in Pure and Applied Mathematics.

Early progress on the projects

Currently, Dr Wang, Professor Yin and Yuting Fu are focusing on two projects about machine learning in financial markets.

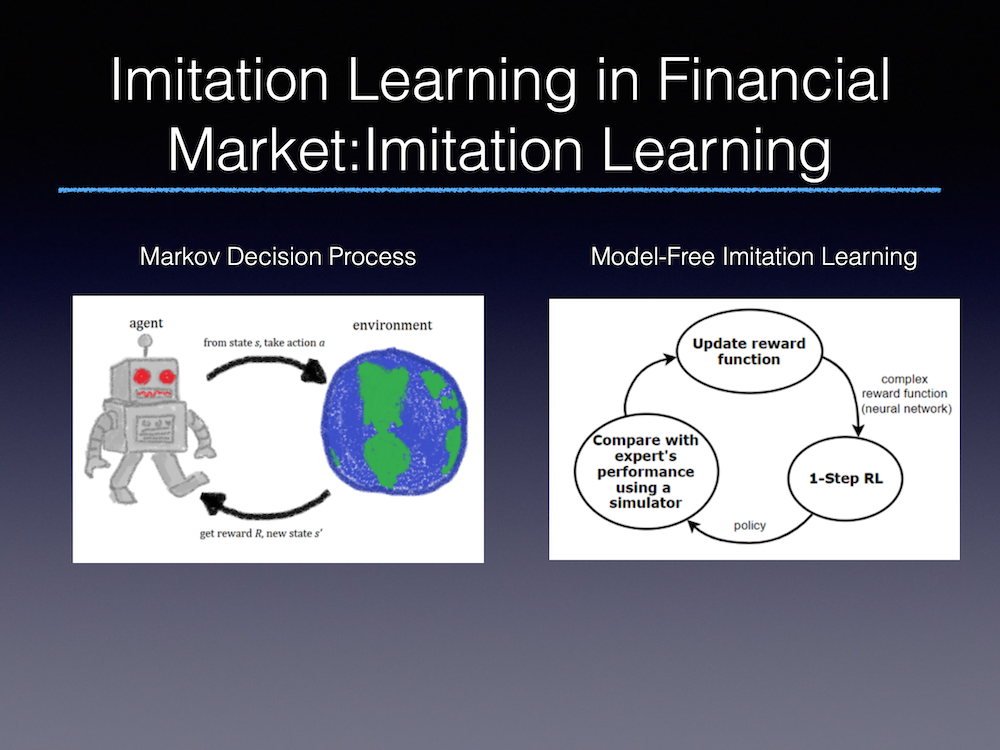

Imitation learning in Financial Markets

The aim of this project is to try to imitate the behavior (decision making) of traders based on their historical portfolio and market data, in order to predict their future decision making.

The team are considering methods like inverse reinforcement learning and generative adversarial imitation learning. There have been a few research projects attempting to apply imitation learning in the financial market and they want to try to make some adjustments and improvements to these models, adapting them to financial market data.

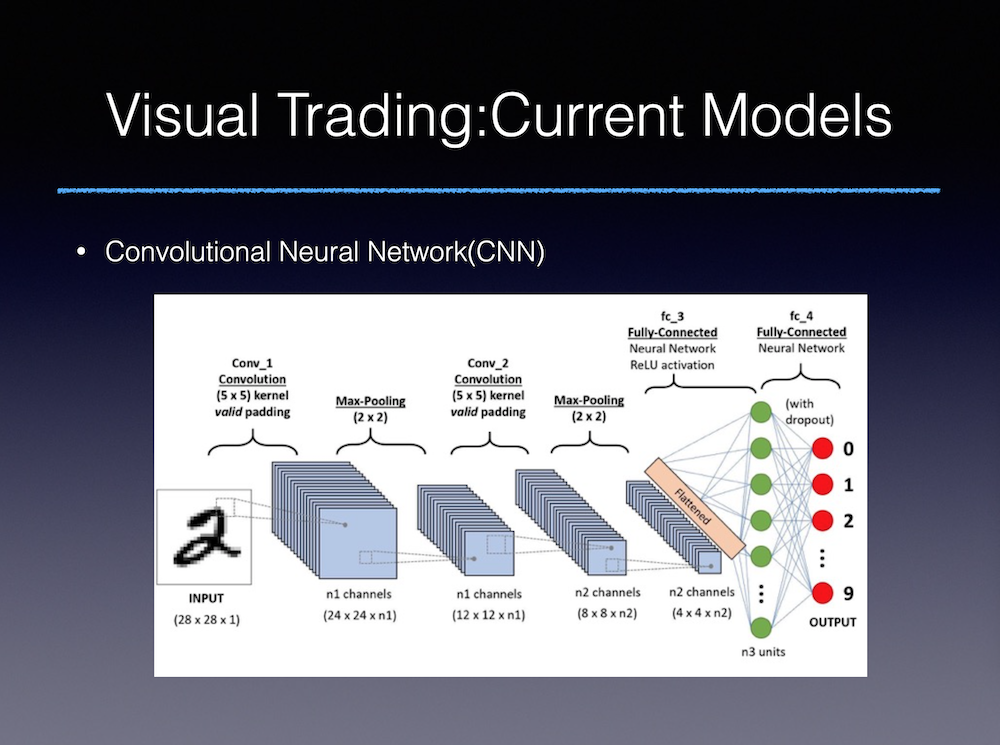

Visual trading

This project is about finding patterns in the candlestick pictures of stock data. Many traders make decisions according to visual information such as candlestick pictures and it is possible to extract useful patterns from these pictures using machine learning techniques. They have been applying standard image classification methods, such as CNN for multi financial time series image classification. However, since CNN does not have time series features, they are looking at convolutional LSTM which is a combination of CNN and LSTM, which allows for the capturing of time series data.

The next step involves considering involving Auto Machine Learning techniques to refine and find better models.

Great progress has been made already since the beginning of the year, when work on this project began. This three year long collaboration promises to produce some innovative and interesting answers to questions, which I look forward to sharing with our open source community.

University of Oxford COVID-19 research supported by HPCC Systems

Dr Wang and his colleagues at the Mathematical Institute, University of Oxford have also been working on a research project which involves using mathematical modelling to estimate and control the outbreak of COVID-19. The research aims were to provide a critical review of epidemiological models used to forecast the evolution of the virus and estimate the effectiveness of various intervention measures and their impact on the economy.

The paper, which is authored by Dr Ning Wang, Yuting Fu, Hu Zhang and Huipeng Shi, has been published. Find out more about their work to provide An Evaluation of Mathematical Models for the Outbreak of COVID-19.

Progress on this research project is ongoing. Yuting Fu plans to carry out mathematical analysis to estimate several key parameters from the pandemic data using HPCC Systems. Additional work on this project also includes the writing of some coding for general dynamic decision making problems.

We are delighted and proud to support the work of Dr Wang and his colleagues, which contributes greatly to the global need for information, analysis and solutions to the unknown and constantly changing COVID-19 situation.